| Sony uses messages rooted in personal relationships, influence, and a sort of peer pressure to encourage prospects to apply for its credit card. |

You are the company you keep. It’s a maxim that’s proving to be valuable for marketers who craft campaigns around their customers’ personal relationships. Savvy marketers recognize that consumers will, many times, purchase what a mother, brother, spouse, or even Facebook friend has bought. That’s because people often trust products and services that their circles advocate. “People buy what their friends buy,” says Ran Shaul, chief client officer of marketing management software company Pursway. Shaul says it’s this social propensity to buy what others buy that often motivates customers—not traditional messaging. “Instead of targeting people based on location or income, [marketers can] target people based on their friends,” Shaul says.

That’s the strategy the marketers for Sony Rewards & Card Marketing decided to use in the face of unmet goals for credit card applications, a limited budget, declining response rates, and email list fatigue. “We needed to drive card acquisition in a cost-effective way, but…we wanted to make sure we weren’t disrupting the relationship that [Sony] already had with customers or hampering future opportunities to market our products to them,” says Aashish Rangwalla, senior manager for the group’s acquisition marketing team. He says the electronics giant initially marketed the credit card to previous buyers of Sony products, but marketers were concerned that sending too many emails or irrelevant messages put off customers: “We didn’t want the people who weren’t the right prospects for a credit card to continue getting emails, which would eventually just lead them to opt-out or unsubscribe.”

Tapping into friends in high places

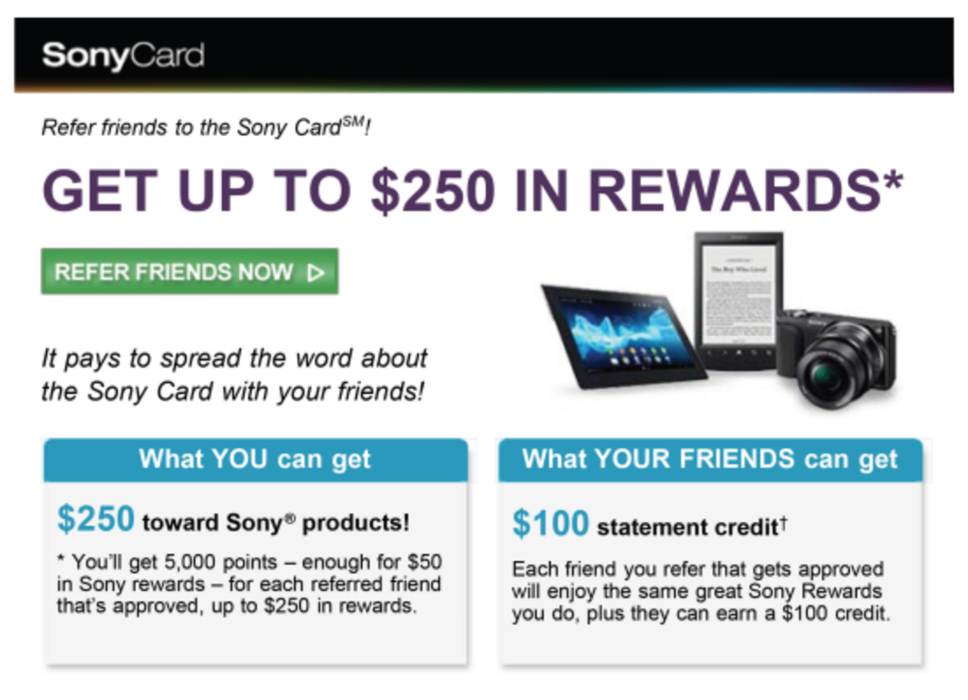

Rangwalla says it was time for Sony to get smarter, and create more refined campaigns based on friends—not solely demographics. So the company now uses tools from Pursway to help develop messages rooted in personal relationships, influence, and a sort of peer pressure. “We always knew we needed to add some basic elements of targeting and segmentation to our marketing,” Rangwalla explains. “But [this time] we worked backwards. We identified the influencers of the [potential customers].”

Marketers at Sony identified people who already have a Sony Card and targeted specific marketing messages and campaigns to friends who would be influenced by them. Rangwalla says that by plotting out customers’ social graphs Sony managed to add on an element of peer pressure—in other words, encourage consumers to apply for a credit card, since their friends have the card. Indeed, those friends, Rangwalla says, are more likely to convince Sony’s target customers to apply for a credit card than if Sony would on its own. And inserting those elements of influence, trust, and peer pressure, Shaul says, helped Sony get more out of the database that the company already had. “If you have a budget to [market to,] say, one million people,” Shaul explains, “choosing the right group of people [yields] much better results.”

The outcome

After adopting this friends-and-family strategy, Sony’s acquisition marketing team says it has seen an increase in applications—about a 380% increase in conversions of email subscribers to either a credit card applicant or a Sony Card holder. “We saw an immediate benefit,” Rangwalla says. “The lift [in the number of applications and cardholders] was campaign over campaign.” He adds that the volume of emails also decreased by about 30%; in other words, fewer messages and less disruption prompted bigger impact and better results. “Once we implemented our targeting strategies, we were able to scale back [on the number of emails].” He says that by using this relationship-based targeting, marketers for the Sony Card are also improving the lifetime value of the company’s email subscribers. “Remember, the goal [of this campaign] is to drive value back to the Sony business units. So from that perspective, the more [Sony customers] that we can get to get a credit card, the more value [each] customer has to those business units.”

Rangwalla says marketers for Sony Card will continue to use intelligence that’s rooted in relationships, influence, and social circles: “We’re now applying a certain degree of sophistication that goes above and beyond traditional [marketing] techniques and methods.”

With a new, more holistic view of Sony customers, marketers at the company will work to craft even more relevant messages that drive card applications. “The next frontier for us is to move toward more triggered, event-based marketing,” Rangwalla says, adding that doing so will enable Sony to get more intimate in its messages. “Eventually, we’re looking to get down to almost a one-on-one relationship level with our customers.”