These days, even a slight growth in the e-commerce sector is cause for celebration. Online sales inched up slightly by 2% in January, compared to a year ago, according to a ComScore report released last week. In December 2008, online sales were down 3% compared to the previous year.

The American Recovery and Reinvestment Act of 2009, signed into law on February 17 with the goal of stimulating the economy, also provides some online retailers with a glimmer of hope.

The stimulus bill includes a $400 tax credit for individual taxpayers, as well as tax credits for those buying new homes and automobiles. But there is controversy regarding how the online retail channel should interpret the news.

“Discretionary spending is still down vs. a year ago, but I view this growth as a positive sign for the e-commerce sector,” said Gian Fulgoni, chairman of ComScore.

According to ComScore, online sales totaled $10.9 billion in January. Among the categories that grew the most were sports and fitness, up 42% vs. a year ago; books and magazines, up 37%; and home, garden and furniture, up 14%.

Conversely, computer software, down 58%; music, movies and videos, down 22%; and office supplies, down 20%; did not fare as well in January.

However, the music, movies and videos category did not include digital downloads, which presumably would have raised that category significantly.

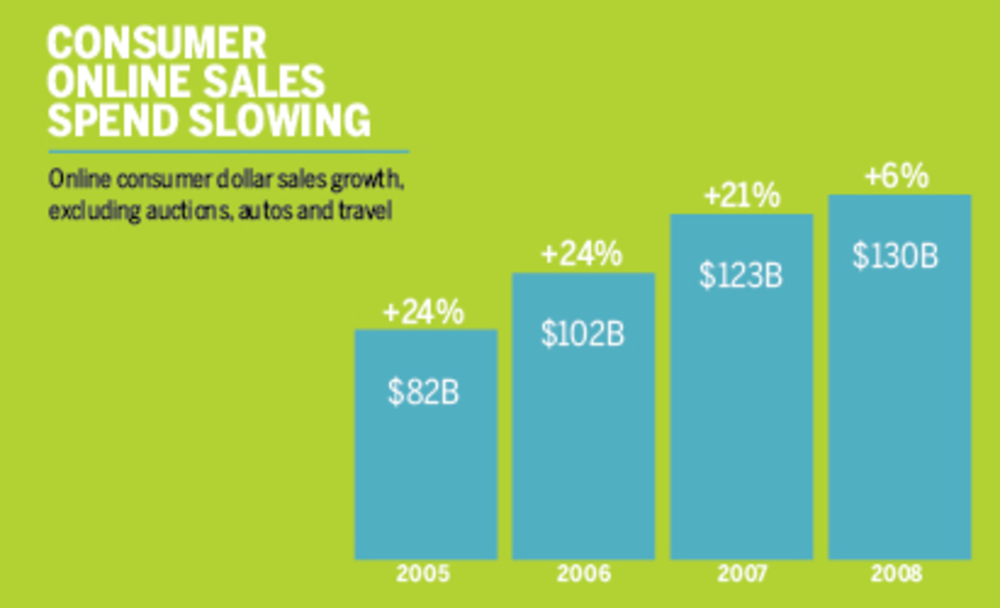

Though e-commerce is slowing, Fulgoni noted that it is still in much better shape than its bricks-and-mortar retail counterpart and other sectors of the economy.

“It may never go back to the huge growth [of several years ago], but it is still gaining market share,” he said.

Patrick Byrne, CEO of Overstock.com, was positive about the slight growth, but has muted expectations going forward.

“We are probably at the new equilibrium,” he said. “I don’t see [e-commerce sales] making a huge rebound anytime soon.”

Byrne added that it was “unlikely” that the stimulus bill would provide a bump in e-commerce sales.

“People are more likely to pay down debt and put cash under their mattress,” he said.

Though Fulgoni said that it was still uncertain whether the stimulus bill would result in a significant bump for e-commerce, he was positive.

“If you look back on what happened in ’08 [after the Economic Stimulus Act of 2008, signed by then-President Bush] there was a bump in e-commerce,” he said. “But the impact was short-lived. It will depend on a number of factors, like unemployment, the price of gas, and whether we are out of the stock market meltdown.”

The National Retail Federation also issued a statement, which said the bill doesn’t go far enough.

“While these and other individual tax provisions will provide stimulus, this massive measure still fails to provide the direct and targeted tax relief needed to stimulate consumer spending,” said Steve Pfister, SVP for government relations at the NRF, in a statement. “With consumer spending representing two-thirds of GDP and consumer confidence at the lowest level since records have been kept, it is difficult if not impossible to foresee an improvement to overall economic growth until consumers regain confidence and resume spending.”

Byrne said one reason why e-commerce is better equipped to handle a recession is that more people use comparison shopping sites today than in the past, and these sites often then lead them to an e-commerce site.

Fulgoni agrees with that sentiment. “It is becoming very apparent” that consumers are using the Internet more and more to make purchasing decisions, he noted.

Because of this, Fulgoni said it is more important for marketers to engage consumers through online channels.

“Savvy marketers really need to consider the Internet a key part of their communications programs with consumers,” he said. “They should be asking themselves, ‘Am I properly allocating my marketing and advertising budgets?’ I think there are pretty dramatic gains that can be made from shifting [marketing and ad budgets] from traditional media to the online channel.”

The slowing of the e-commerce sector in the fourth quarter of 2008 also coincides with a slight downturn in satisfaction with e-commerce sites, according to a survey released by the University of Michigan and ForeSee Results.

The report found that satisfaction with the e-commerce sector dropped 2% to 80 on the American Customer Satisfaction Index (ACSI) 100-point scale in the fourth quarter. The drop halts a three-year climb, but satisfaction with the e-commerce sector still out performs most other service sectors of the economy.

Much of the drop is due to satisfaction with the online brokerage industry plummeting 6.3% to 74, and is the largely responsible for the 2% dip in satisfaction for the overall e-commerce sector.

“Despite the drop in satisfaction, e-commerce is still one of the best performing service sectors of the economy in all of ACSI, but it is far from immune to the challenging economic conditions,” said Larry Freed, president and CEO of ForeSee Results.

Freed said online brokerage sites like TD Ameritrade and E-Trade “got hit hard” as smaller investors had less money to invest, while brokers that serve larger investors, like Charles Schwab, were not hit as hard.

Overall, although it is growing at a slower rate, e-commerce is still a popular channel, Freed said.

“I think it’s an industry that is in very, very good shape,” he said. “It’s a great alternative to traditional channels.”