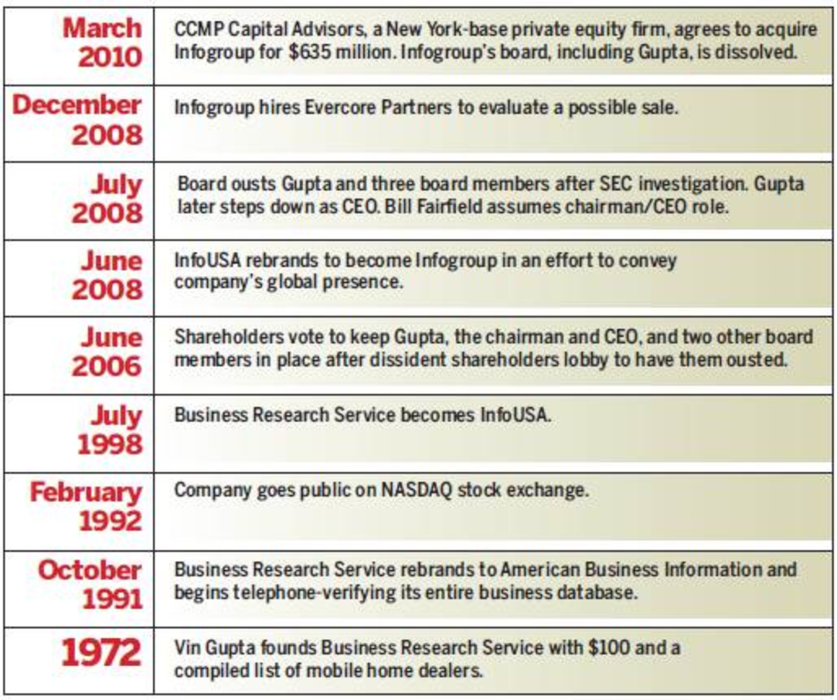

CCMP Capital Advisors, which bought Infogroup for $635 million on March 8, plans to continue Omaha, NE-based Infogroup’s transition from database company to full-service direct marketing firm.

“We think this is a huge opportunity to generate an attractive ROI,” Richard Zannino, managing director of CCMP, told DMNews. “There are certain fix-up aspects and transformational aspects to the deal. We will continue to transform the company from a traditional database company into a direct marketing provider.”

The acquisition, expected to close this summer, will result in Infogroup becoming a private company. Dave Frankland, senior analyst at Forrester Research, said changes can me made more easily under the new structure.

“Their CEO speaks of the firm as a federation of businesses,” he said. “When it comes to bringing those businesses closer together, that’s hard to do under the scrutiny of quarterly earnings. It’s easier to make decisions [as a private company].”

Last year, Infogroup rebranded its various units with a common name and logo to eliminate confusion in the marketplace over its many direct marketing businesses.

Michael Darviche, CMO of data competitor Acxiom, said he wasn’t surprised by the acquisition. He said the deal bodes well for other database companies.

“I think this means that people are seeing value in data, and we all know that terrific amounts of new data are being generated daily,” he said. “Companies that know how to sort and find patterns and insights for direct marketing and risk management will be valuable. Marketing continues to evolve in ways that are exciting and powerful on new devices and in new channels.”

Darviche added that there are opportunities to use data in secure processing, consumer compliance and privacy.

Sources close to the deal told the Omaha World-Herald last month that Dun & Bradstreet was among the bidders, but withdrew its offer after changing leadership. D&B would not comment on the acquisition.

The deal also means that Vin Gupta, Infogroup’s founder and former CEO and chairman, will no longer be involved with the company, said Kevin O’Brien, managing director at CCMP. Gupta founded InfoUSA and served as chairman until 2008, when he was accused of using company money for personal expenses.

“The board will be dissolved at the closing of the deal,” he said. “Vin will have no ongoing involvement. He’s signing an agreement where he will vote his shares in favor [of the deal], and we expect he’ll monetize those shares as part of the closing.”

Gupta stepped down from the board March 11, the AP reported.

Bill Fairfield, CEO of Infogroup, said in a statement that the deal will benefit company shareholders, clients and employees by creating “greater stability, focus and flexibility to make strategic, long-term investments.” An Infogroup representative could not be reached for comment at press time.

Fourth-quarter 2009 revenue at Infogroup dropped 11.3% year over year to $125.8 million, from $141.9 million.