Today’s modern marketer is not suffering from a shortage of technology and tools to better understand and engage current and prospective customers. From Marketo to Radian6, marketers are challenged to gauge which technologies to acquire and implement based on their most critical organizational needs.

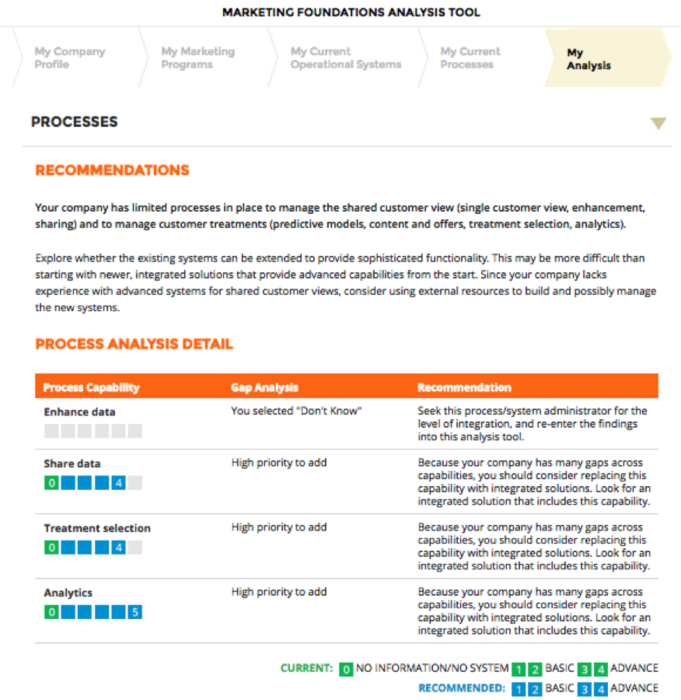

SAP, a provider of solutions for customer engagement and commerce, recently launched a Marketing Gap Analysis Tool specifically to address this marketer pain point. Collaborating with Raab Associates, Inc. SAP developed the free interactive tool that asks the marketer a series of questions about their organizational profile, marketing programs, current systems and processes. Based on the answers, the tool makes personalized recommendations on focus areas for marketing investment to address existing gaps.

“There are changing rules of customer engagement from a marketing perspective. Marketers understand their customers are changing and understand what they need to do, but they don’t know how to do it,” said Bernard Chung, Senior Director, Solution Marketing, SAP. “This is because marketers traditionally operate on the creative side and all the sudden they need to be savvy in data and analytics; they must really understand the technology and tools they are using,”

Mr. Chung is responsible for representing SAP to the broad marketing audience, and over the past 15 years he has focused on, among other things, connecting and engaging with marketers and understanding the tools and technologies they need to be successful. It was based on these interactions and market observations that drove Mr. Chung to design a simple tool for marketer who understand their systems and technology well enough to walk through a basic process that provides a directional recommendation on what they need to invest in and focus on from a technology perspective.

“These discussions with marketers were the genesis for creating the tool with David Raab, who is very experienced and was a critical source of information in creating logic for the tool itself,” Chung adds. “David brought a comprehensive methodology, and we sat down and distilled his process and methodology into critical steps. Based on how marketers answer these questions in the tool, specific recommendations are made based on each selection.”

The tool asks the marketer a series of questions, starting with the basics: annual revenue range, what industry is your company in, geographic location and how open is it to change. From there, the tool digs into current marketing activities such as prospect profiling, interactive promotions, loyalty program and brand monitoring – asking not only if your organization is using tools for these activities but also if they are capabilities you are interested in acquiring. The tool then shifts to the degree of data integration and how connecting marketing systems are with other business processes such as email, websites, CRM and mobile.

In terms of what type of company the tool is designed for, Mr. Chung indicates that while it has been broadly used, larger enterprises and midsized organizations that are most active with marketing tools would ideally receive the greatest benefit. The results so far indicate, according to Mr. Chung, that many marketers are still struggling with the basics such as gaining a single customer view of data and tying different systems together. The SAP Marketing Gap Analysis Tool is constructed to address the need for these basics, but also more sophisticated gap analysis around strategies to consider in general architecture, such as integrated suite, shared customer data platform or application-based; industry-specific issues, such as regulatory concerns; and identification of gaps in specific marketing systems.

Once the marketer completes the tool’s questions – which take about 10-15 minutes – a recommendation summary report is emailed on the gaps to fill and the potential next steps. There is also a link to a webinar that explains the underlying methodology and process that went into the “black box” of the tool itself, as well as a white paper that explains what the results mean in broad terms.

As far as SAP’s objectives for the tool, Mr. Chung comments that: “We hope the outcome for marketers is valuable, directional recommendations on where they need to focus on from a technology perspective. Should they keep what they have, buy, or build? So far we’ve had a good response with over a thousand marketers taking the survey itself, as well as several asking for follow-on engagements.”