By Richard Romero, President & CEO, Seattle Credit Union

Seattle is a very different city today than it was 85 years ago when we first opened our doors as City Credit Union. For that matter, it’s a different city today than it was even five years ago, before Amazon became the behemoth of retail. That’s the beauty and defining feature of a dynamic market – it’s always changing.

Our mid-sized credit union has done our share of changing too. But as Seattle’s financial landscape became fast-paced, and hyper-competitive, over the last few years, we knew we had to find new ways of doing business and delivering compelling customer experience to our credit union members.

Today’s Seattleites (like most American consumers) aren’t looking for rigid, impersonal banks. They want to conduct most of their financial business online or via their mobile device. However, when they do visit a branch, they’re often looking for more than transactional services – they need education about their financial status, advice about their future, and meaningful interactions with their financial partners. Were we creating spaces and opportunities to meet those needs?

The courage to change

We took a good, hard look at ourselves and found that while our core operations still met our members’ financial and banking needs, we needed to revitalize our brand to better serve them. We enlisted our experiential design partner—Twenty Four 7 out of Portland, Oregon — in this endeavor. Together, we identified where we could improve our customer experience across all of our consumer touchpoints. It caused us to rethink our approach so that for the next 85 years, Seattle Credit Union would be the type of organization our members value, and our non-members notice.

Podcast: Agencies, Brands, And Consumer Demands

They confirmed what we suspected—that for all the experience and stability that our long history conveyed, Seattle Credit Union needed to become more aligned with today’s Seattle. We needed our in-branch experience to complement our digital, and mobile, presence. We needed our brand to reflect the savvy, globally-minded members we serve.

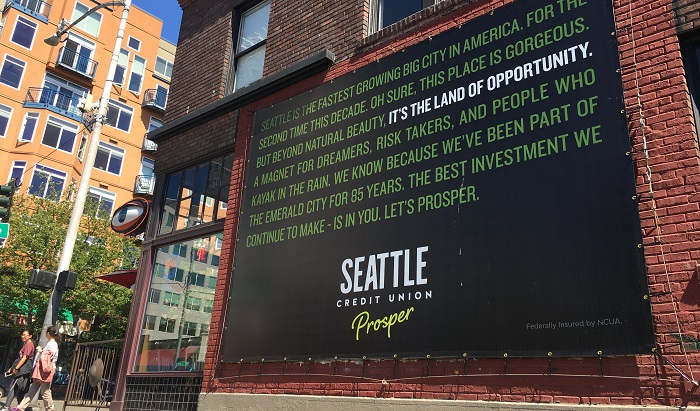

Armed with the information from our brand audit, we made the decision to rename our company (we were founded as City Credit Union, became Seattle Metropolitan Credit Union in 1997, and this time dropped the “Metropolitan”). Seattle Credit Union was born, and we set off to create a more holistic brand experience.

With our agency partner, we redesigned the interior space, or “architectural flow,” of our branch locations —replacing traditional teller lines with the self-serve technology our customers told us they wanted, and eliminating big, impersonal conference rooms, in favor of communal spaces conducive to genuine conversations. These renovations were a physical embodiment of our ultimate goal: to create a financial “classroom” for the community where we can serve as financial allies and mentors for our members.

We also overhauled our website and mobile app with the same goals in mind: to be more attuned to our members’ needs and preferences for engaging with us, and to be better positioned to help them navigate their financial lives. When we completed our rebrand, we conducted a community outreach campaign, inviting Seattle to take another look at the institution they thought they knew.

What we learned

We learned quite a bit through the process:

- You don’t know what you don’t know. We certainly knew our business, but not what transformation was needed, or how to make the required changes as effectively and efficiently as possible. Twenty Four 7 was instrumental in this area.

- How to embrace change. With all of the transformation Seattle has gone through, and the changes technology has imposed on how consumers interact with brands, we had to be willing to adapt our business model across all mediums. We learned that even 85-year-old companies like ours need to be nimble and responsive.

- There is immense benefit in creating a consumer experience that is integrated across all touchpoints. The physical and digital experience must go hand in hand. Yes, most of our customers now encounter our brand through the online and mobile channels, but our branch experience must serve as a complement, not just a duplication. The physical expression of our brand—the branch location—still does what can only be done in-person, while empowering members to find their place in it.

- Take risks. Rebranding itself always carries some degree of risk, especially for an established brand like ours. But in working with a creative partner, we were able to see our brand experience through a new lens and found unique ways to promote Seattle Credit Union throughout the city. We had the opportunity to better engage our community and promote our brand in an authentic, but targeted way. And by taking that leap we were able to connect with our current and prospective members in ways we never would have dreamed five years ago.

Moving forward

I’m proud to say that throughout this process, we never lost sight of who we are. We still help the people of Seattle finance their first home, send their kids to college, and start new companies. But now our brand is as nimble and personal as our ever-changing city. And while I’m sure we’ll change some more in the next 85 years, we’re in a better position now to serve our city and region than we’ve ever been before. Together, we prosper.